So you want to get into bitcoin? Don’t do what I did: spend about $60 in banking fees that turned my investment of $150 into $90. I always said my investment strategy is buy high, sell low, but I didn’t think it would happen in a matter of microseconds.

So you want to get into bitcoin? Don’t do what I did: spend about $60 in banking fees that turned my investment of $150 into $90. I always said my investment strategy is buy high, sell low, but I didn’t think it would happen in a matter of microseconds.

Actually, it took the better part of a week. I first wrote about bitcon a few weeks ago here and got some great comments, along with a recommendation to read this book by two WSJ reporters that I found very interesting. Then I decided to take the plunge and set things up. I found it wasn’t as easy as, say Paypal or Square, two apps that I use more or less all the time when I have to move money around.

If you want to enter the bitcoin universe, you need the following:

- A digital wallet to store your bitcoins. The one that I am using is Bitpay’s Checkout, but if you are going to be serious about storing a decent amount of value you probably want to use Copay, which asks for multiple signatories to move money around. Think of this like Square: you set up a transaction and then hand over your phone or tablet to your customer, who sends you money. Instead of taking a day or so to get into your bank account and being charged a 2.75% fee, you get the funds with almost no fees that goes to your wallet within a few minutes.

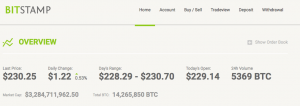

- An exchange. I set up my account on Bitstamp.net and that took some doing. The exchange is where you can move money from one currency to another or to bitcoins. You probably don’t need to start out with an exchange, but I wanted to have flexibility and also prepare myself for when I could become a day trader (JK). I liked Bitstamp because they had good reviews and handled a variety of currencies, including Euros. We’ll get to that whole experience in a moment

- Access to a wire service from your bank to fund your initial account. More on that too.

First there is the exchange. They operate on a know your customer basis, meaning they want to see some documents that prove you are whom you say you are. That gives me some small measure of comfort. So I had to scan my passport, my utility bill, and so forth. I made the mistake of using my corporate bank account to send them a wire: that held things up for a few days while they wanted to see my corporate bank statement and answer a few other questions about why I wanted to use their services. Once we got everything working, they charged me a $7 fee to move my money into their system. Buying or selling bitcoins comes with another small fee of 0.25% per transaction.

Then my bank, which proceeded to charge me $45 for an international wire transfer to Europe, where Bitstamp is located. Sigh. That was the easy part, once I decided to accept that fee in the interests of science. The wire transfer takes a few minutes. Normally it would take Bitstamp a few minutes to recognize the transfer, but because I messed up and used my corporate account, it took a few days. Good thing I wasn’t trying to send a lot of cash this way.

As a side note, this outrageous wire fee is one of the reasons that bitcoin is catching fire. The fees are very low to move money around, in some cases almost nothing. But the bad news is that the value of the currency moves up and down very aggressively: at one point one bitcoin was worth $1200; now it is somewhere in the low $200s.

Then it came time to setup Bitpay. You first set up an account via the Web, and connect it to your bank account (if you want dollars out) or to your bitcoin account (if you want those out). They have a few other questions to ask you and documents to scan as well to prove who you are. They also have an interesting tier structure. When you first get your account you are set at tier 0, which entitles you to transfer $100 a day. The way they work, you send more documentation, they up your limit. Tier 1 is $1000 a day, and now I am at Tier 2, which is $10,000 a day with an annual limit of $500,000. This is all conducted via the Web, where you upload your scans, then they send you emails telling you that your account has been upgraded. And did I mention, there aren’t any fees? At least not yet.

The final step is to link your Bitpay wallet on your phone with your account. On the web, you go to Payment Tools and then Point of Sale app, where you add a pairing code, similar to how you would pair your phone on Bluetooth. You enter this code on your phone and your account is all setup. To test things I was able to send bitcoins from my exchange to my wallet. It was almost as exciting as sending my first Internet email message through MCIMail. (I know, I get off on some strange stuff.)

Was it all worth it? Certainly not the involuntary wire fee. But in the future I could use one of the bitcoin so-called ATMs that dot the landscape (we have one in St. Louis so far): they only charge about 8% fee to transfer funds, which is more typical of what my credit card company charges when I buy something abroad. And when one of my clients wants to pay me in bitcoin, I will be ready!

Curious as to how/if Bitstamp would work with credit union accounts, since credit unions aren’t part of the international banking system and require the non-US bank to use a corresponding bank in the US to transfer funds.

Pingback: Bitcoin is more than just about the coins | David Strom's Web Informant