If you are looking for a small business accounting software service, don’t consider WaveApps, Sage or the site And.co. All of them use the banking connector Plaid.com and have a major shortcoming. Let me explain my journey.

When I first began my freelancing business in 1992 (can it be?), I used the best accounting program at that time: QuickBooks for DOS. It was simple, it was easy to setup, and it did the job. I stayed with QB when I went to Windows and then to Mac, upgrading every few years, either when my accountant told me that they couldn’t use my aging software or when Intuit told me that I had to upgrade.

When I first began my freelancing business in 1992 (can it be?), I used the best accounting program at that time: QuickBooks for DOS. It was simple, it was easy to setup, and it did the job. I stayed with QB when I went to Windows and then to Mac, upgrading every few years, either when my accountant told me that they couldn’t use my aging software or when Intuit told me that I had to upgrade.

I use my accounting software for three things:

- To keep track of my expenses and payments, entering information once or twice a month to stay on top of things.

- To produce invoices and to accept credit card payments from my clients

- To produce reports once a year for my accountant to produce my business tax filings

That isn’t a lot of requirements to be sure. Naturally, over time some of them have changed: when I first began my accountant directly read my QB file. Now she just wants a few year-end statements, which almost every accounting tool can produce. Also, enabling credit card payments isn’t a big deal that it once was: there are so many other solutions that don’t have to originate from the accounting software tool itself (such as Square, for example).

One thing that hasn’t changed is my goal: having to spend as little time as possible using the software, because this means that I have more time to spend actually writing and doing the work that I get paid to do.

But installing software on my desktop is so last century. Eventually, Intuit stopped making physical software and every QB version is now in the cloud. Their solutions start at $25/month, discounted for the first few months. Actually, that isn’t completely accurate: they also have a “self-employed” version for $15/month, but it has so few features that you can’t really use it effectively – such as producing those yearend reports that I need for my accountant.

Several years ago, I found Waveapps. It was free, it had just enough features to make it useful for me (see above) and did I mention it was free? I started using it and was generally happy. One of the nice features was how it connected to my corporate checking account at Bank of America and imported all my transactions, which made it easier to prepare my books and track my payments.

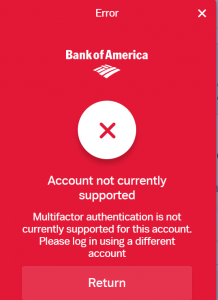

A few weeks ago, Wave decided to “upgrade” its banking connector to Plaid. And that broke my BofA connection. The problem is that I have setup my banking login to use an SMS text multi-factor authentication (MFA). I wish BofA offered something better, but that is what they have — they call it “extra security” — and so I use it. Plaid doesn’t support my bank account’s “extra security” MFA setting.

A few weeks ago, Wave decided to “upgrade” its banking connector to Plaid. And that broke my BofA connection. The problem is that I have setup my banking login to use an SMS text multi-factor authentication (MFA). I wish BofA offered something better, but that is what they have — they call it “extra security” — and so I use it. Plaid doesn’t support my bank account’s “extra security” MFA setting.

This begins The 2020 Accounting Software Evaluation Project. It deserves the capital letters because it meant that I had to start looking around, reading software reviews, signing up for the software service providers, and checking them out. I very quickly found that Sage and And.co (I do hate their domain name) also use Plaid as a banking connector, so I wasn’t getting very far by switching to them. Meanwhile, here we are into February and I still haven’t decided on what to do with my accounting software.

I took time to email the PR person at Plaid, who initially told me that the BofA MFA issue was a bug and they were working on a fix. That was a lie, or perhaps a misunderstanding. Eventually, this is what I got from them: “Plaid supports the standard MFA for Bank of America and most of the other 11,000 institutions on the Plaid network, but we do not currently support BofA’s perpetual MFA setting.” This is also not true. BofA only offers a single MFA method: sending SMS texts to your phone. I wish they offered a smartphone authenticator app, but they don’t.

So my dilemma is this: should I eschew security for convenience? I can turn off the MFA and get my accounting data imported, and then will have to turn it back on. I could try to switch accounting providers to something else — I haven’t tried all of the small business providers, but I have a feeling that Plaid has them as customers too. I could find another bank that has better security and perhaps works with Plaid, but that would mean changing a lot of my bill paying data too.

No good choices, to be sure. I guess I will just stick with Wave for the time being, but I am not happy about it. Secure users shouldn’t use plaid.com.

I’ll provide feedback to BofA, where I have my biz account, too.

I was interested to see that the link you provided (start looking around) has Xero as a best buy.

That may not be the best choice for you, but I’m intrigued that it appeared there.

I came across it doing some work for a client. Had never heard of it before that. But then I found how enthusiastic the users around the world were, even if not in the US. So now I am interested to see if it will catch on here.

In my mind it is more of an accounting program than QB. You have to do things in the right way, whereas in QB a journal entry will allow you to convert anything to anything ! (Very convenient, but very dangerous)

Some more info via my wife who does accounting for a small distributor of industrial goods and serves as treasurer for a small non-profit. The distributor uses Sage (ex-Peachtree), which is so last century. She switched her non-profit to QuickBooks from Kashoo, which is nice for smartphones but wanting in ease of use and helpful features. So avoid both Sage and Kashoo.

Have you looked at the accounting software in Linux world?

Another reader writes:

I’ve used these guys a little bit https://sunriseapp.com/ but didn’t connect it to my bank account. They use Yodlee https://www.yodlee.com/legal/yodlee-security and appear to support 2FA. https://help.buxfer.com/hc/en-us/articles/360019601034-Does-Yodlee-support-two-factor-authentications-for-my-financial-institutions-

i’ve been using WaveApps for a little over a year~ i like that it’s like a shoebox, and nothing gets lost… but the change also bounced importing from Venmo, and a lot of my clients like to pay me that way :/ works fine with my Wells Fargo biz accounts, but i’d love to dump WF, so… no help here.

looking forward to hearing what you come up with… if i find anything, will let you know.

Reverse problem for me: My bank doesn’t seem to work with Quickbooks Online, which does NOT seem to use Plaid.

So, I’m evaluating Sage, Freshbooks, Xero, and Kashoo.

I would actually prefer one that uses Plaid, as I expect that to be the more reliable long-term option for authenticating to banks. I’m sorry your BOA account doesn’t seem to work w/ Plaid.

FYI, I just chose Xero. Works w/ my bank and integrates w/ Gusto!